Over the last 14 years Mexican Peso (MXP) has devaluated 83% vs US Dollar(USD), this is great news for US, Canadian & European home buyers looking to close their mortgage denominated in Pesos; this means EFFECTIVELY LESS USD needed to pay for your MXP Peso denominated loan over time.

What you need to know about financing your DREAM HOME in Mexico!

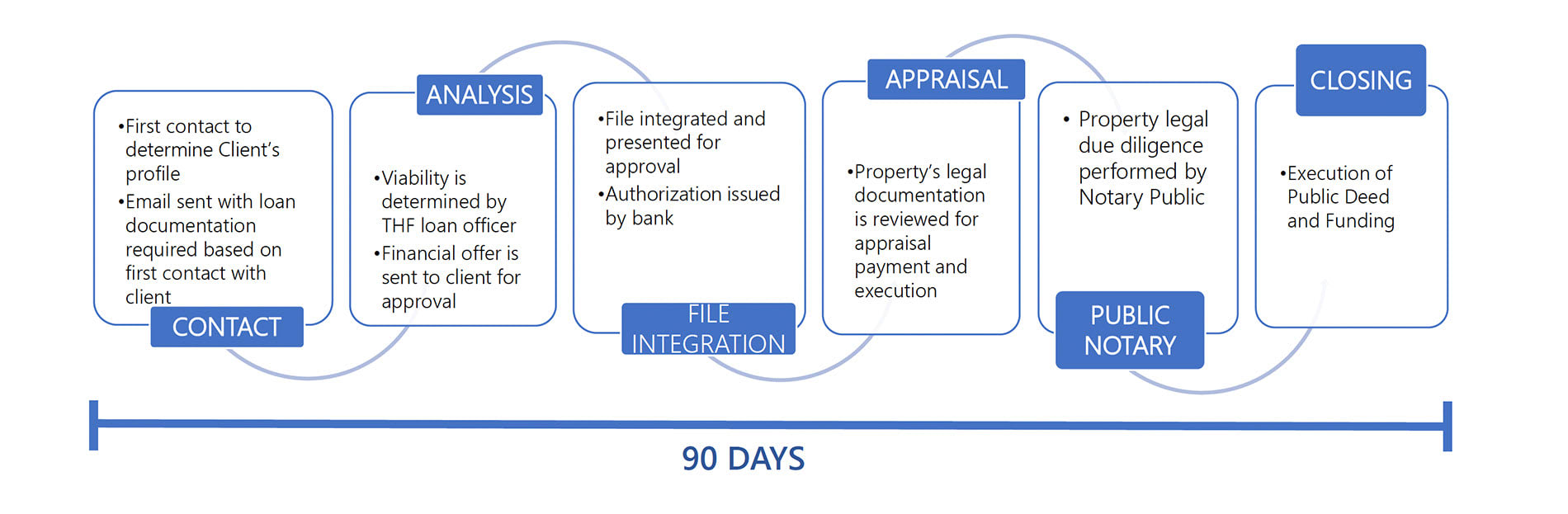

Financing is easy and mirrors similar process of those in the United States, Canada and most European countries:

• Earnest money or down payment is paid to the builder or seller. Typically 10% to 30% of the agreed price

• Appraisal fee ($350-$600)must be paid once the credit has been authorized

• All deals close at the bank’s office or at Public Notary’s office

• Due to Mexican land ownership limitations for foreigners, ownership of the property must be performed via a Mexican Trust to which you will be the second beneficiary as long as any loan amount is outstanding and upon payment of the loan you will become sole beneficiary

• Banks used for financing are either HSBC or Santander depending on our Client’s unique profile

Your will need the following to purchase:

• Set up bank account before closing with HSBC or Santander depending on your unique profile, once the credit has been approved

• 680 Minimum FICO Score

• 70% Loan to Value with 30% down payment

• 7%-8% closing costs due at closing (down payment + closing cost = 38% approximately)

• 5yr, 7yr, 10yr, 15yr or 20yr terms available

• Fixed rate estimated between 9.50% and 10.50% depending our your profile

• 40% debt to income ratio including future monthly payments of Mexican loan

• 2yrs Tax Returns –To determine income, GROSS income (before taxes) is used

• The borrower shall be the person or persons that evidence income. Income is evidenced through the respective annual income tax filling

• Mortgage payments are NOT evidenced on U.S., Canadian or European Credit Reports

• No pre-payment penalties

• Fee payable upon authorization is 2.5% of the loan

• A $350 USD origination fee must be paid once the Client’s file is submitted.

PROCESS

If you need more information, please contact one of our Real Estate Agents, and the will guide you.